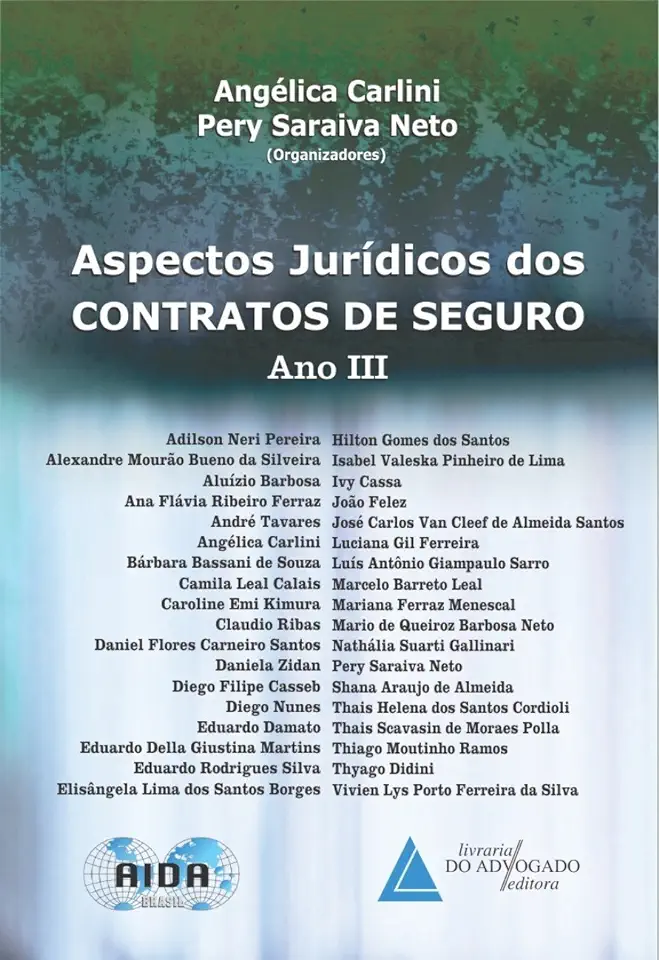

Legal Aspects of Insurance Contracts - Year 3 - Angélica Carlini

Legal Aspects of Insurance Contracts: A Comprehensive Guide for Year 3 Students

Introduction

Welcome to the world of insurance contracts! This comprehensive guide, tailored specifically for Year 3 students, delves into the intricate legal aspects that govern these crucial agreements. Written by the esteemed legal scholar Angélica Carlini, this book is your gateway to understanding the complexities of insurance law and its impact on various stakeholders.

Understanding Insurance Contracts

Insurance contracts serve as the foundation of the insurance industry, providing a safety net for individuals and businesses against unforeseen risks. This section of the book provides a thorough overview of the nature and purpose of insurance contracts, shedding light on their essential elements and the legal principles that govern their formation and interpretation.

Key Elements of Insurance Contracts

At the heart of every insurance contract lies a set of fundamental elements that define the rights and obligations of the parties involved. This section delves into these key elements, including the subject matter of insurance, insurable interest, utmost good faith, and proximate cause. Gain a deeper understanding of how these elements shape the legal framework of insurance contracts.

Formation and Validity of Insurance Contracts

The process of forming a valid insurance contract is crucial to ensure its enforceability. This section explores the legal requirements for a valid contract, such as offer and acceptance, consideration, and capacity to contract. Additionally, it addresses the concept of insurable interest and its significance in determining the validity of insurance contracts.

Interpretation of Insurance Contracts

Interpreting insurance contracts can be a complex task due to the use of specialized legal terminology and ambiguous language. This section provides a comprehensive analysis of the principles and techniques used in interpreting insurance contracts, including the contra proferentem rule and the doctrine of reasonable expectations. Learn how to navigate the complexities of contract interpretation and ensure a fair and just outcome for all parties involved.

Rights and Obligations of Policyholders and Insurers

Insurance contracts create a web of rights and obligations between policyholders and insurers. This section examines the legal duties and responsibilities of both parties, including the duty to disclose material facts, the duty to act in good faith, and the duty to indemnify. Gain insights into the legal framework that governs the relationship between policyholders and insurers, ensuring a balanced and equitable distribution of rights and obligations.

Claims and Dispute Resolution

Despite the best efforts to prevent disputes, claims may arise under insurance contracts. This section explores the legal processes involved in handling and resolving insurance claims, including the notice of loss requirements, the investigation process, and the various methods of dispute resolution, such as negotiation, mediation, and litigation. Understand the legal framework that governs the claims process and the strategies employed to achieve fair and timely resolutions.

Regulatory Framework of Insurance Contracts

Insurance contracts operate within a complex regulatory framework designed to protect the interests of policyholders and ensure the stability of the insurance industry. This section provides an overview of the regulatory bodies and laws that govern insurance contracts, including the role of insurance regulators, the impact of consumer protection laws, and the implications of international insurance regulations. Stay informed about the legal landscape that shapes the insurance industry and ensure compliance with applicable regulations.

Conclusion

"Legal Aspects of Insurance Contracts - Year 3" by Angélica Carlini is an indispensable resource for students seeking a comprehensive understanding of the legal framework governing insurance contracts. With its clear explanations, insightful analysis, and practical examples, this book equips readers with the knowledge and skills necessary to navigate the complexities of insurance law and excel in their academic and professional pursuits.

Call-to-Action

Don't miss out on this opportunity to enhance your understanding of insurance contracts and gain a competitive edge in the legal field. Order your copy of "Legal Aspects of Insurance Contracts - Year 3" today and embark on a journey of legal discovery that will empower you to confidently handle insurance-related matters and contribute to the fair and just resolution of insurance disputes.

Enjoyed the summary? Discover all the details and take your reading to the next level — [click here to view the book on Amazon!]