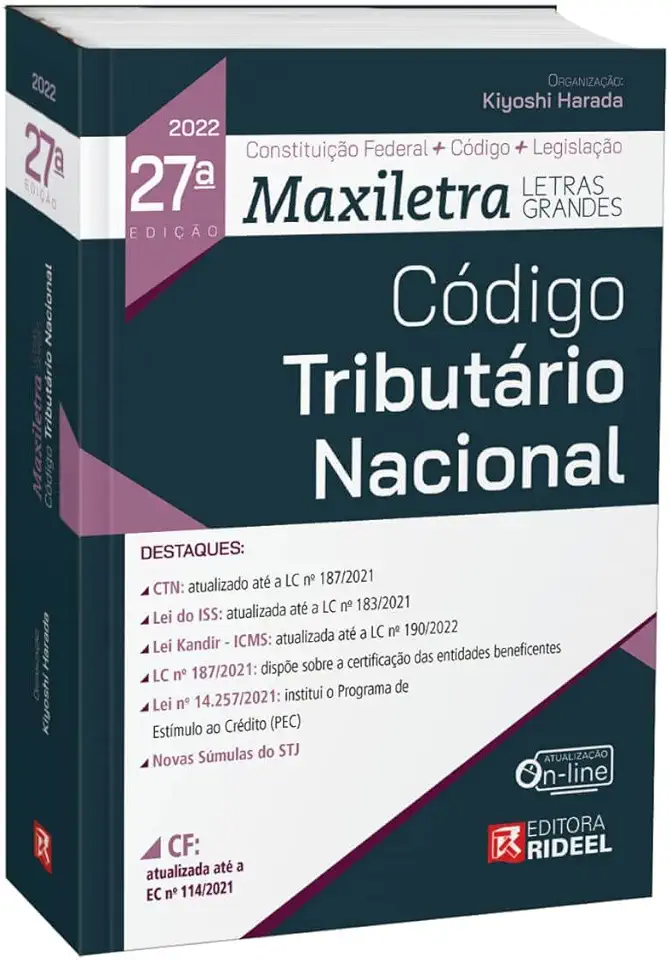

National Tax Code - Kiyoshi Harada

National Tax Code by Kiyoshi Harada: A Comprehensive Guide to Understanding and Navigating the Complexities of the U.S. Tax System

Introduction: Unraveling the Labyrinth of Tax Laws

In the ever-evolving landscape of financial regulations, the National Tax Code stands as a formidable yet essential guide for individuals and businesses alike. Written by renowned tax expert Kiyoshi Harada, this comprehensive book provides a thorough understanding of the intricate web of tax laws that govern the United States. With its user-friendly approach and wealth of practical insights, National Tax Code empowers readers to confidently navigate the complexities of the tax system, ensuring compliance and maximizing financial opportunities.

A Comprehensive Overview of Tax Regulations

National Tax Code offers a comprehensive overview of the U.S. tax system, covering a wide range of topics, including:

Individual Income Taxes: Gain a clear understanding of the various tax brackets, deductions, and credits available to individuals, ensuring accurate tax preparation and potential savings.

Business Taxation: Explore the intricacies of business tax laws, including corporate income taxes, partnerships, and S corporations, enabling businesses to optimize their tax strategies and minimize liabilities.

Property Taxes: Delve into the complexities of property taxation, including assessments, exemptions, and appeals, empowering readers to make informed decisions regarding their real estate investments.

Estate and Gift Taxes: Navigate the complexities of estate planning and gift-giving, ensuring the smooth transfer of wealth and minimizing tax burdens for heirs and beneficiaries.

Practical Insights and Real-World Examples

National Tax Code goes beyond mere theory, providing practical insights and real-world examples to illustrate the application of tax laws in various scenarios. These examples help readers grasp the nuances of tax regulations and make informed decisions that align with their financial goals.

Expert Guidance and Strategies for Tax Optimization

Throughout the book, Kiyoshi Harada shares his expertise and offers valuable strategies for tax optimization. Readers will gain insights into:

Tax-Efficient Investment Strategies: Discover how to make investment decisions that minimize tax liabilities and maximize returns, ensuring long-term financial success.

Retirement Planning: Learn how to leverage tax-advantaged retirement accounts, such as IRAs and 401(k)s, to save for the future while minimizing current tax burdens.

Business Tax Planning: Explore effective tax strategies for businesses, including entity selection, deductions, and credits, to enhance profitability and competitiveness.

Stay Up-to-Date with the Latest Tax Developments

The tax landscape is constantly evolving, and National Tax Code ensures readers stay informed with regular updates and supplements. This commitment to providing the most current information ensures that readers can confidently navigate the ever-changing tax regulations and make informed financial decisions.

Conclusion: Empowering Financial Success through Tax Knowledge

National Tax Code by Kiyoshi Harada is an indispensable resource for anyone seeking to understand and navigate the complexities of the U.S. tax system. With its comprehensive coverage, practical insights, and expert guidance, this book empowers individuals and businesses to make informed financial decisions, optimize tax strategies, and achieve long-term financial success. Invest in your financial future and gain the knowledge and confidence to master the National Tax Code today!

Enjoyed the summary? Discover all the details and take your reading to the next level — [click here to view the book on Amazon!]