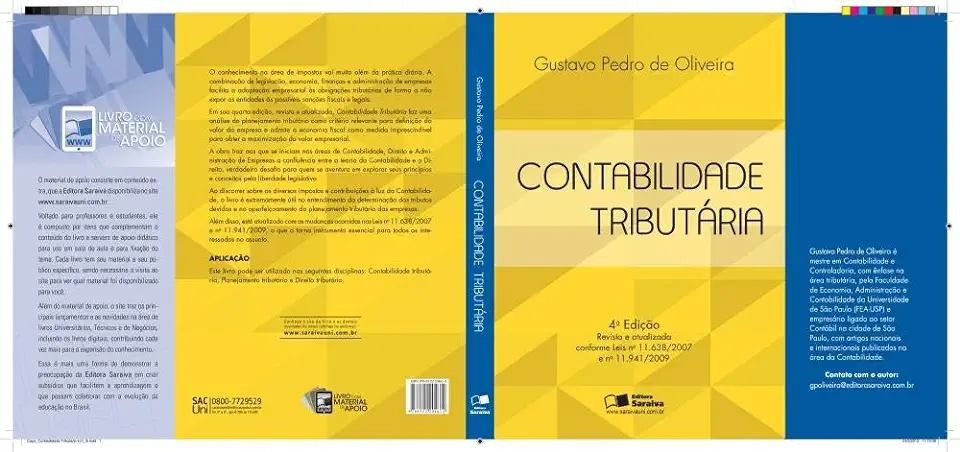

Tax Accounting - Gustavo Pedro de Oliveira

Tax Accounting: A Comprehensive Guide to Tax Accounting Principles and Practices

Introduction

Tax accounting is a specialized field of accounting that focuses on the preparation and filing of tax returns. It is a complex and ever-changing field, as tax laws are constantly being updated. However, it is also an essential field for businesses of all sizes, as it can help them to minimize their tax liability and maximize their profits.

What is Tax Accounting?

Tax accounting is the process of recording, classifying, and summarizing financial transactions in a manner that complies with tax laws and regulations. It involves the preparation of tax returns, the calculation of tax liability, and the management of tax payments.

Why is Tax Accounting Important?

Tax accounting is important for businesses of all sizes because it can help them to:

- Minimize their tax liability: By understanding the tax laws and regulations, businesses can structure their transactions in a way that minimizes their tax liability.

- Maximize their profits: By taking advantage of tax deductions and credits, businesses can increase their profits.

- Avoid penalties and interest: By filing their tax returns correctly and on time, businesses can avoid penalties and interest.

Who Needs Tax Accounting Services?

All businesses need tax accounting services, regardless of their size or industry. However, some businesses may need more specialized tax accounting services than others. For example, businesses that operate in multiple states or countries may need to deal with complex state and international tax laws.

What are the Different Types of Tax Accounting Services?

There are a variety of different tax accounting services that businesses can choose from, including:

- Tax return preparation: This is the most basic tax accounting service, and it involves the preparation and filing of tax returns.

- Tax planning: This service involves working with businesses to develop strategies to minimize their tax liability.

- Tax representation: This service involves representing businesses before the IRS or other tax authorities.

- International tax services: This service involves helping businesses to comply with the tax laws of other countries.

How to Choose a Tax Accountant

When choosing a tax accountant, it is important to consider the following factors:

- Experience: The tax accountant should have experience working with businesses in your industry.

- Qualifications: The tax accountant should be a certified public accountant (CPA) or have other relevant qualifications.

- Fees: The tax accountant should charge reasonable fees for their services.

- References: The tax accountant should be able to provide references from satisfied clients.

Conclusion

Tax accounting is a complex and ever-changing field, but it is also an essential field for businesses of all sizes. By understanding the tax laws and regulations, businesses can minimize their tax liability and maximize their profits. If you are looking for a tax accountant, be sure to choose someone who is experienced, qualified, and affordable.

Enjoyed the summary? Discover all the details and take your reading to the next level — [click here to view the book on Amazon!]