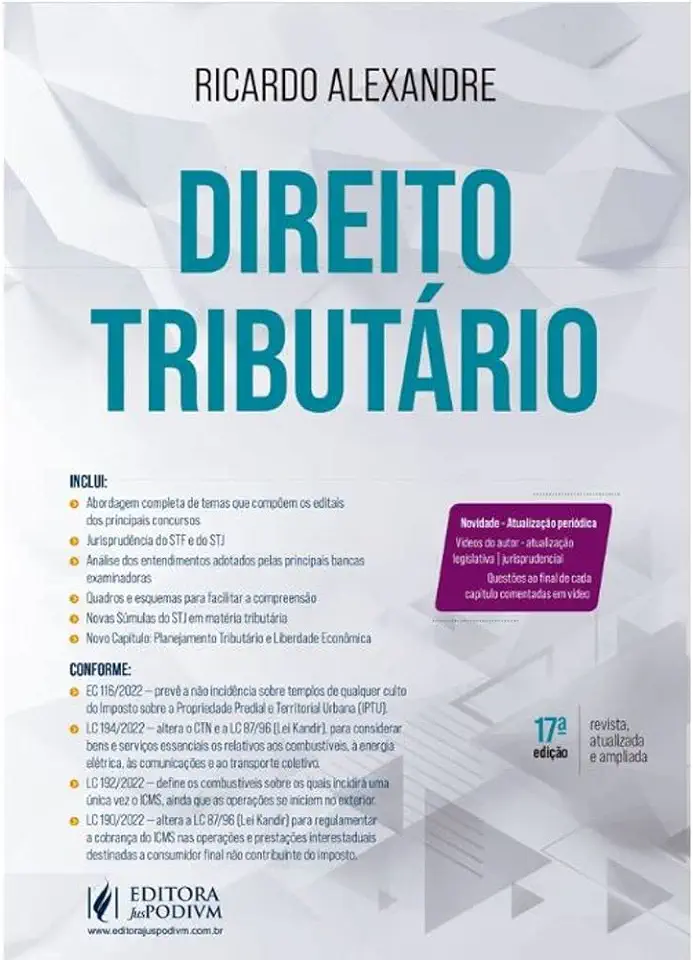

Tax Law Outlined - Ricardo Alexandre

Tax Law Outlined: A Comprehensive Guide to Understanding and Navigating the Complexities of Tax Law

Introduction

In today's rapidly evolving financial landscape, staying abreast of tax laws and regulations has become increasingly crucial for individuals and businesses alike. Ricardo Alexandre's comprehensive guide, "Tax Law Outlined," offers a clear and concise roadmap to understanding the intricacies of tax law, empowering readers to make informed decisions and optimize their financial strategies.

Navigating the Maze of Tax Regulations

"Tax Law Outlined" provides a comprehensive overview of the fundamental principles and concepts that underpin tax law. From income tax and capital gains tax to inheritance tax and value-added tax, Ricardo Alexandre meticulously explains each aspect, ensuring that readers gain a thorough understanding of their tax obligations.

Expert Insights and Practical Guidance

Drawing from his extensive experience as a tax law expert, Ricardo Alexandre offers invaluable insights into the practical application of tax laws. He delves into real-life scenarios, case studies, and examples, illustrating how tax laws impact individuals and businesses in various situations. This hands-on approach enables readers to grasp the complexities of tax law and make informed decisions that minimize their tax liability.

Stay Updated with the Latest Developments

Tax laws are constantly evolving, and "Tax Law Outlined" ensures that readers remain up-to-date with the latest changes and amendments. Ricardo Alexandre regularly updates the book to reflect new regulations and rulings, ensuring that readers have access to the most current information available.

Empowering Individuals and Businesses

"Tax Law Outlined" is an indispensable resource for individuals and businesses seeking to navigate the complexities of tax law. Its comprehensive coverage, practical guidance, and expert insights empower readers to take control of their financial affairs, optimize their tax strategies, and make informed decisions that maximize their wealth.

Key Features:

- Comprehensive Coverage: Covers a wide range of tax topics, including income tax, capital gains tax, inheritance tax, value-added tax, and more.

- Expert Insights: Provides valuable insights from a seasoned tax law expert, offering practical guidance and real-life examples.

- Up-to-Date Information: Regularly updated to reflect the latest changes and amendments in tax laws.

- Empowering Individuals and Businesses: Empowers readers to make informed decisions, minimize tax liability, and optimize their financial strategies.

Conclusion

"Tax Law Outlined" is a must-have resource for anyone seeking to understand and navigate the complexities of tax law. Ricardo Alexandre's comprehensive guide provides a clear and concise roadmap to financial success, empowering individuals and businesses to make informed decisions and maximize their wealth. Invest in your financial future and get your copy of "Tax Law Outlined" today!

Enjoyed the summary? Discover all the details and take your reading to the next level — [click here to view the book on Amazon!]